TEXAS, USA — It’s not a “buyer’s market” yet, but it’s definitely not the “seller’s market” we were seeing just several months ago.

San Antonio had its smallest month-to-month home price increase in 2022, inching up from $339,317 in May to $340,000 in June. The Houston area also logged the smallest increase we have seen this year, going up just a notch to $351,500 in June from $350,000 the month before.

For the first time this year in DFW, home prices stayed steady from one month to another, holding at $430,000 from May to June. And in Austin, the monthly change in the median home price went down for the first time in 2022, dropping from $550,000 in May to $537,475 in June.

It helps to put a damper on prices when more homes for sale are on the market. We’re seeing that happen in a big way in big Texas cities. In June, there were more months of housing inventory in each of the largest metros.

There was 1.8 months of supply in DFW. That’s more than we have seen since September of 2020. The 2.1 months of supply in San Antonio was the most since October 2020. Houston had a 1.9 month supply, the most since December 2020. And the 2.1 months of supply in Austin was the most inventory we have seen since pre-pandemic November 2019.

Many Texas home buyers at risk of being outbid by out-of-towners

Are you one of many people here who found a home you loved this year, but a lot of other people did, too? Maybe you put in an offer – a great offer – only to have a competing bidder outdo you with an even better offer that was out of your reach.

If all that sounds familiar, you may have been up against an out-of-town competitor. People moving in from somewhere else have been packing a lot more money than local relocators.

Redfin has been keeping score on this. In the Austin area, the out-of-towners typically had a maximum home purchasing budget of $964,811 versus $896,956 among established Austinites. Looking at the max amounts around San Antonio, outsiders out-budgeted the 'hometowners' $514,485 to $460,499.

In the greater Houston area, the home team has been losing by even more, with a top homebuying budget of $518,398 compared to the visitors, who are willing to bring up to $608,902 to get the home. But D-FW is home to the biggest disparity, the folks from elsewhere willing to spend up to $815,613 compared to the upper limit of $667,404 for the local buyers.

Pay is up. But so are home prices.

It has helped many homebuyers that they have gotten pay bumps in the pandemic recovery, which is reflected now in accelerating median family incomes in major Texas cities. Here are the figures from the Texas Real Estate Research Center: Austin is up 11.5%, San Antonio is up by 12.7%. The median family income in the Houston area has increased by 13.8%, and in D-FW by 9.4%.

That’s the good news. The problem is those incomes are being strained by our exploding home prices in Texas and by interest rates, which have risen significantly and quickly in 2022.

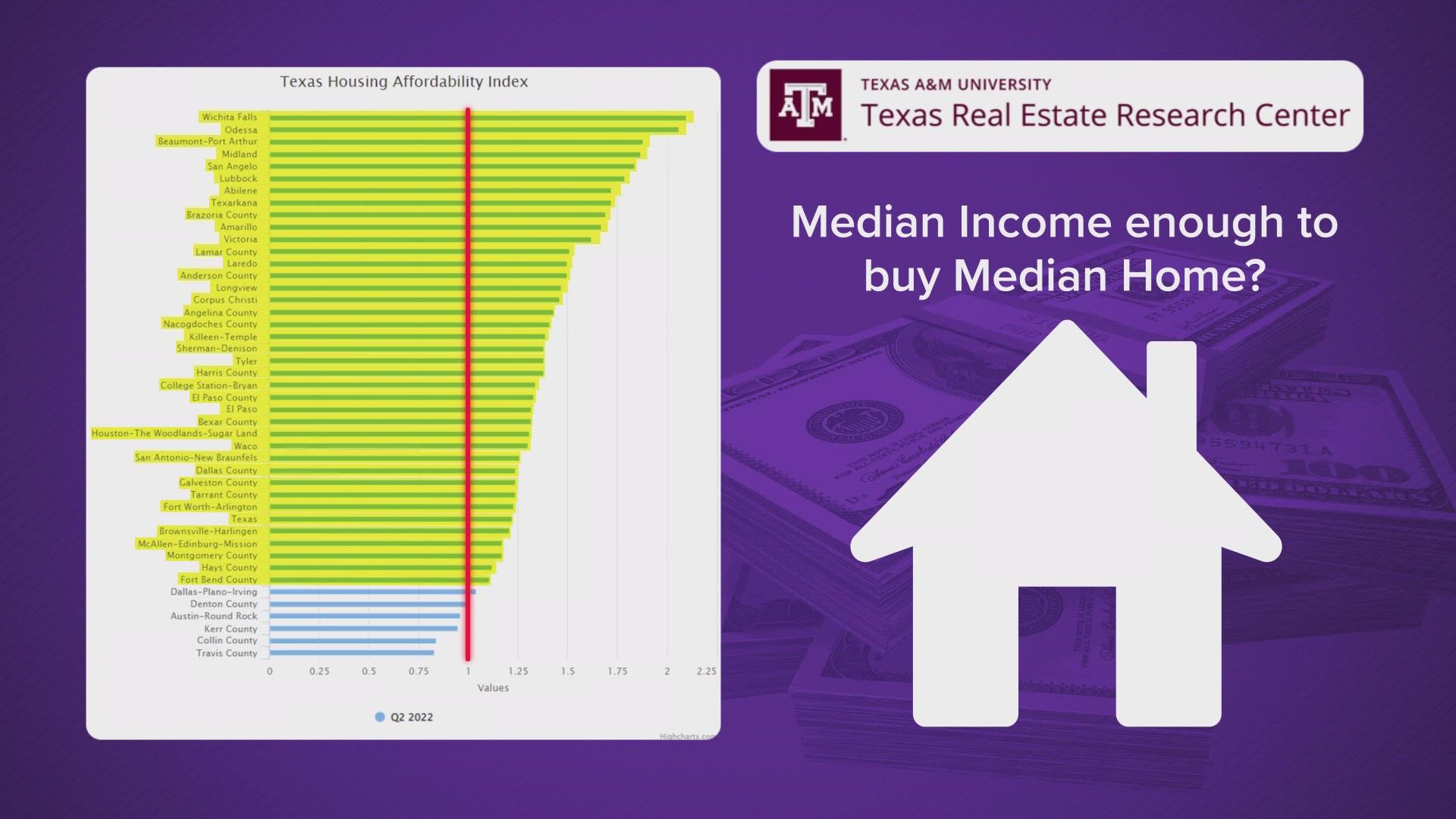

In some parts of Texas, the median income can’t afford the median home

The Texas Real Estate Research Center keeps tabs on affordability with the Texas Housing Affordability Index (THAI), which they say “Measures the relationship between the median family income and the required income to purchase the median priced home in a particular locale”. The center reports that in the most recent quarter, affordability in many Texas markets declined.

The THAI is based on a ratio. Anything above a 1.00 is considered to still be in “affordable” territory, and most of Texas is still in that territory in this chart.

Dallas-Plano-Irving is still just barely in the “affordable” range. Denton County is right on the affordability line. But in several spots, including Travis County and Collin County, the median income is no longer enough to afford the median house, according to the research.