SAN ANTONIO — Funny money from a COVID-19 fund

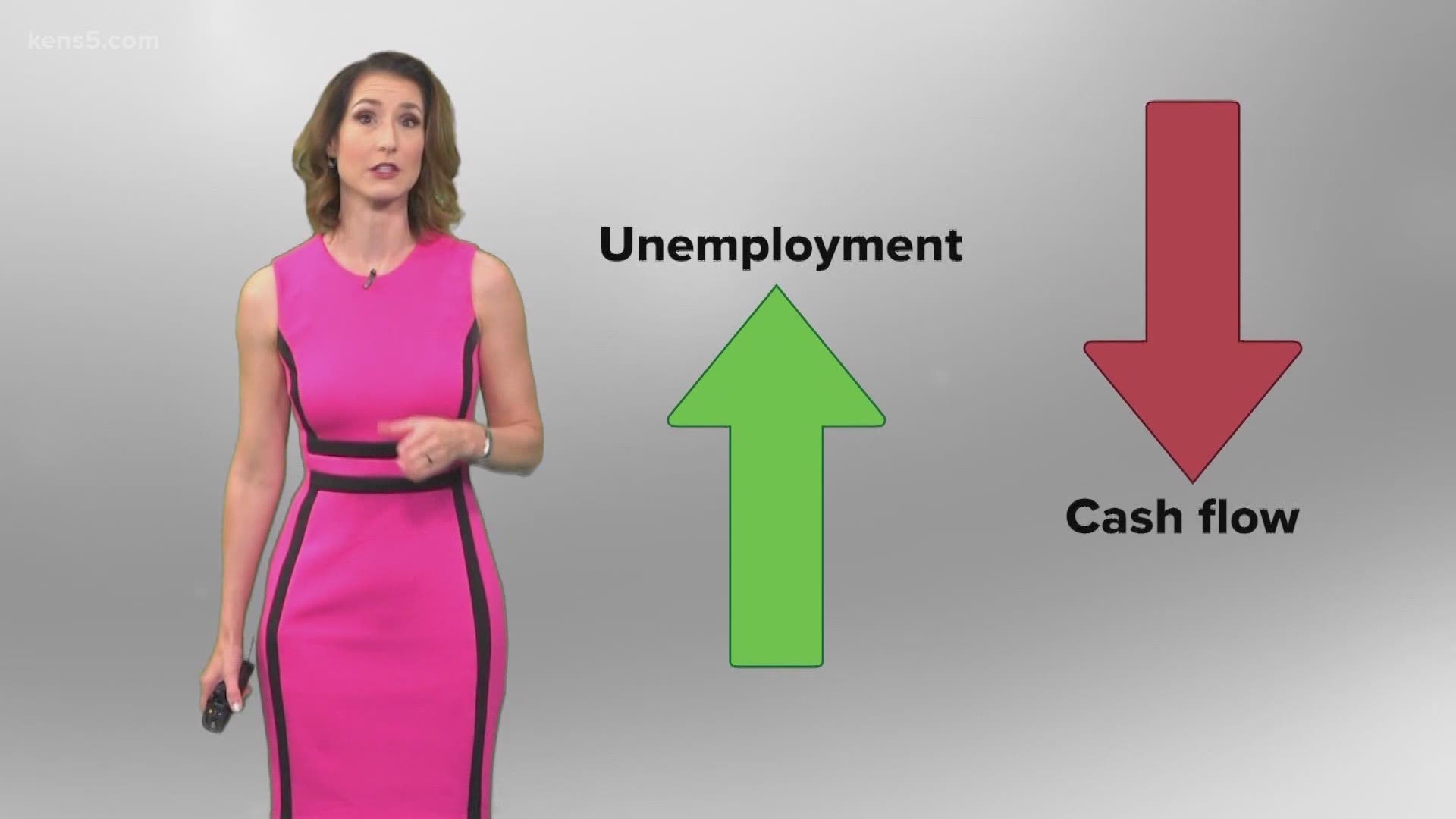

We could all use some extra cash, but emails about money from a coronavirus fund are fake. The Federal Trade Commission (FTC) said with high unemployment rates and low cash flow for many, schemers are trying to trick you to get your personal information.

The email says you will get money from a COVID-19 Global Empowerment Fund; you just need to provide your bank information or credit card number. This puts you at risk for identity theft. There is no fund and no money, so do not respond.

If you encounter this scheme or any other, file a complaint with the FTC so others can be warned.

Phony mask exemptions cards are circulating

A recent executive order requires us to wear masks at Bexar County businesses, but some people cannot wear them because of a disability. You might have seen mask exemption cards circulating on social media. They say the holder does not need to wear a mask.

It often carries the seal of the U.S. Department of Justice or of the federal agencies responsible for enforcing the Americans with Disabilities Act (ADA). These cards are not issued by the government, nor are they enforced by it.

Instead, let a business know you are unable to wear a mask and ask employees to work with you to get what you need. For more information about your rights under the ADA, click here or call 800-514-0301 or 800-514-0383 (TTY).

Dealing with the debt of a deceased loved one

Some have lost loved ones because of the coronavirus. Debt does not disappear when a loved one dies, however, and many of us are already cash-strapped.

It does not mean you owe, either. You are most likely responsible for the unpaid debt if you are a spouse or cosigner. If there is not enough money in the estate of the deceased to cover the debt, it typically goes unpaid. Find the exemptions here.

Here is what to do when a collector calls: Collectors can only talk with certain people about a deceased person’s debt, including a spouse, parent, guardian, executor, administrator or anyone authorized to pay debts with assets from the estate. If a collector does not know the correct person to reach, they can contact other relatives to ask for the right contact. They can only call each person once and they cannot give details of the debt or ask the relative for payment if they are gathering contact information.

It should also be noted that collectors cannot lie or imply a relative has to pay the debt. You can also send a letter disputing the debt. Be specific about why you do not owe, but give as little personal information as possible. You have 30 days after getting the validation notice of the debt (which says how much you owe, to whom and what to do if you think you do not owe) to send a written response.

If you feel the collection calls are harassing, send the collector a letter telling them to stop contacting you and the estate. Keep a copy for your records. Stopping the calls does not cancel the debt. It is possible you might be sued or have debt reported to a credit bureau.