CORPUS CHRISTI, Texas — Tax season officially gets underway today. That means if you already have your tax return, you can file your taxes for 2023.

Here is everything you need to know in order to rake in your refund this year.

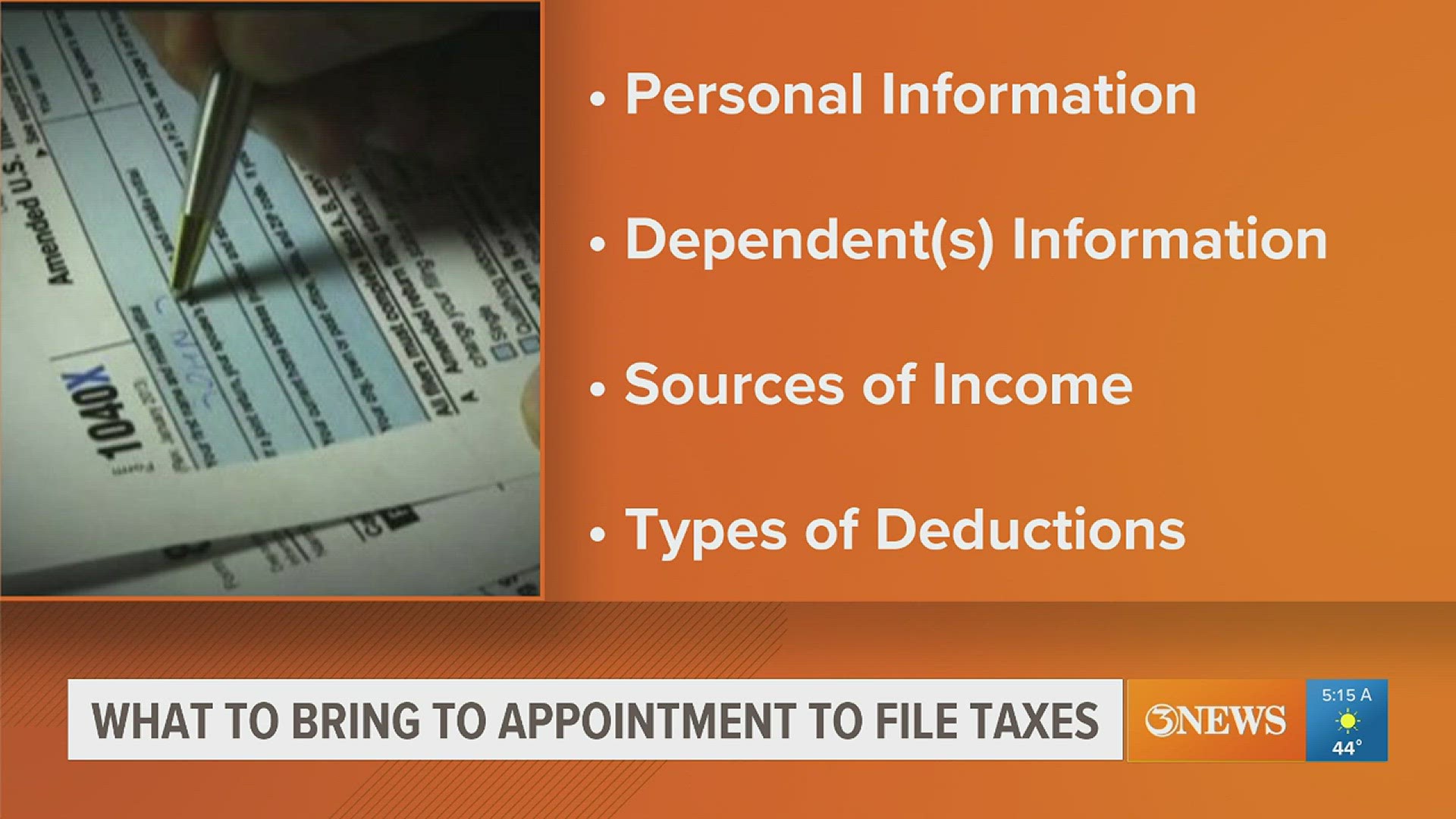

What you need for your tax game plan

If you are planning on filing with a certified public accountant or tax preparer, you need your W-2. If you do not have that yet, your employer has until this Wednesday, Jan. 31, to get it to you.

Also, be sure you have your social security number or tax ID and bank account information.

If you have dependents, make sure to bring their childcare records and dates of birth as well as social security numbers.

What to bring to the tax preparer's office

Make sure you bring any sources of income, which includes a W-2 form or 1099. If you are self employed, you will also need to bring records of all your expenses.

Be sure to bring in items that count as deductions too, such as charitable donations, medical expenses and health insurance.

Tax changes

Inflation has been at a four-decade high – and there are some changes taking place this year.

First, there are wider tax brackets that are now adjusted up by a record seven-percent. If your income stayed relatively flat, you could end up in a lower tax bracket and with the lower tax rate that comes with it.

There are also higher standard deductions that were adjusted to account for inflation.

Tax scams

Tax scams are prevalent across the country with fraudsters often trying to impersonate the IRS. There are some big red flags to watch out for.

First, the IRS will not threaten you.

Also, be suspicious if the person contacting you asks for a specific payment method.

The IRS will not call you asking for your credit card number or other personal information, and they will never contact you through text messages or social media.

If you want to verify the IRS is reaching out to you, call 1-800-829-1040.

When to expect tax refunds

Legally, the IRS must wait until mid-February to issue refunds. Tax preparers will remind you to be patient about those refunds.

For people who use direct deposit with no other issues, the earliest date you can start seeing your tax return is Feb. 27th. On average, it takes three weeks or longer if you file electronically and choose direct deposit.

Track your refund

If you want to track your refund, you can do that through the IRS' "Where's My Refund" page. This will let you know if your return was rejected, received, approved or sent.

You will need to wait at least 24-hours after filing before you can track your return. So if you file today, you will need to wait until tomorrow to begin tracking.

The wait is even longer if you file by mail, which can take up to a month.

TAMUK VITA program

Students at Texas A&M University Kingsville are helping with tax season through their Volunteer Income Tax Assistance (VITA) program. Services are free for taxpayers with a household income under $66,000.

There are three options to help you out including virtual meetings, a curbside drop-off or in-person at the university's business administration building.

You can learn more about the VITA program at the link here. You can also find out more information about the 2024 tax season at the IRS' official website.

More from 3News on KIIITV.com:

- Volunteers lend a gloved hand at Saturday's Wreaths Across America pick-up event

- It's time for a 3NEWS Roundup! Take a look at all the fun we had the NCJLS Friday

- Alice enters Stage 2 drought restrictions

- Permit for proposed Enbridge Ingleside plant denied in Tuesday's special city council meeting

- Beach permits for 2024 are now available for purchase

- Local baseball instructor William Roland dies

Subscribe to our YouTube channel for your daily news and exclusive extended interviews.

Do you have a news tip? Tell 3!

Email tell3@kiiitv.com so we can get in touch with you about your story should we have questions or need more information. We realize some stories are sensitive in nature. Let us know if you'd like to remain anonymous.